Published: February 27, 2018

Filed Under: Market Trends, Real Estate Investing

Have you seen all the new construction just a little bit north of the LSU campus?

Yes, I said north … not south. If you drive up there you will see new building after new building being built. My husband came home the other day and said, “What is that?”

Well, it’s LSU’s Nicholson Gateway Development. It’s 28 acres that will include apartment homes for upperclass men and women as well as graduate students. It also includes rec space, retail space, parking, and the LSU Foundation offices. The project is funded jointly by the LSU Property Foundation and private developers.

You’d think with all the new rental construction going on south of the LSU campus that we wouldn’t need anymore student housing. And, if you own a townhome or a condo nearby that your children live in while attending LSU you’ve got to be wondering what impact all this will have on your property values.

During the past few years we’ve seen new construction at The Cottages (now The Lodges at 777), The Exchange, Arlington Cottages and Townhomes, Wildwood, The Woodlands, Sterling Burbank and I’m sure I’ve left out a few. Not surprisingly, it’s about the money and what it costs to send your child to LSU.

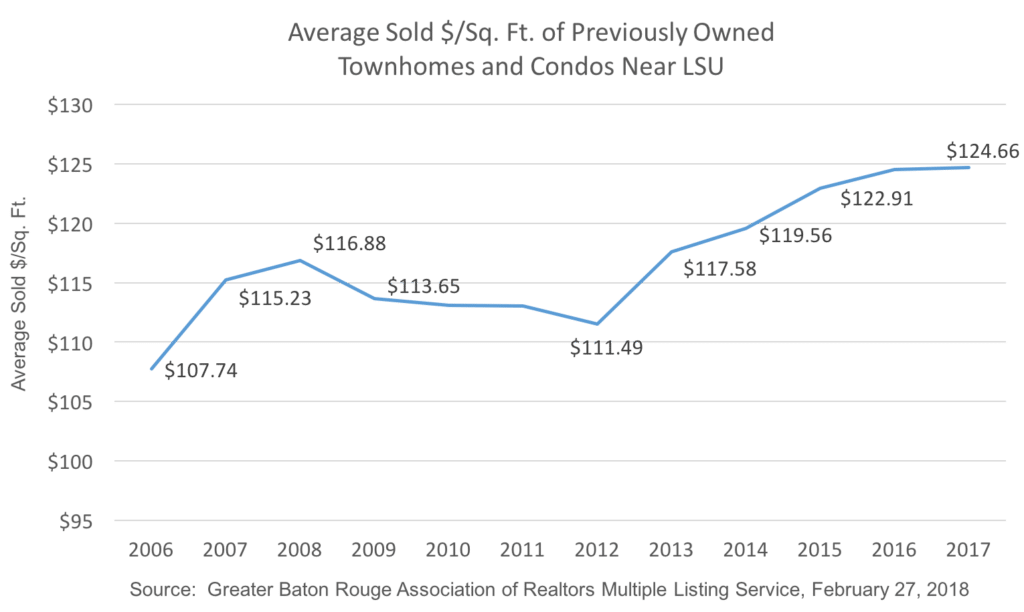

The graph above includes all attached home sales (condos, townhomes, and duplexes) in MLS area 52 that were previously owned, i.e., not new construction. I decided to eliminate new construction from this analysis because it really is very different from the inventory of existing homes. Including those homes in the year they were introduced really screws these numbers.

What you see is that after Katrina we had a run up in the cost of condos, townhomes, and duplexes in the area. Some of that was speculative, and some was just a concern about having a place to go if you lived in New Orleans and a major hurricane was on it’s way. But around 2008 our market started to shift. There are a number of factors that contributed to this, and honestly, these averages smooth the losses in value in some student-centric neighborhoods near LSU.

When you combine the post-post Katrina effect of New Orleans residents returning home, with the problems the US economy was experiencing in 2008 – 2011, it’s not surprising that parents were not too keen on buying property for their children. Having worked with many parents during those years what I heard was,

“When the stock market looses that much value, you just don’t feel as comfortable buying a second home for your kids.”

What changed?

In 2011 The Cottages of Baton Rouge opened. They were nice. They were new. And they were expensive. As more and more new apartments were built, with rents around $700- $800/month per student for a 2 bedroom apartment and $600 – $700/month per student for a 3 bedroom apartment, the surrounding existing inventory started to once again become attractive.

A 2 bedroom/2 bath apartment at LSU’s new Nicholson Gateway Apartments will cost you $4,940/semester per student. That’s $9,960 for two semesters, and if you stay for the summer months it’s an additional $2,470. So that’s a little more than $1,000/month!

Click here for a link to the fee schedule. That’s pretty swank for a college kid. I have no doubt they will be very nice and a needed and welcome addition to the north side of the campus. For most of the parents I work with, however, they’re still going to be interested in some lower cost alternatives on the south side of the campus.

Published: February 7, 2018

Filed Under: Market Trends

While you may not know it from our recent temperatures, Spring is right around the corner. As we head into an historically busy time of year for home sales, many of my clients have asked about current market conditions and what’s in store for 2018.

Last week I read with interest The Advocate’s article on 2017 home sales in the greater Baton Rouge area. Yesterday The Business Report shared Corelogic’s report on home values in the Baton Rouge area. And while most of this is good news, those of us who live in and around the LSU area know that this part of town is a little bit different. Near LSU, home prices are the highest in the metro area, land is scarce, and we weren’t as directly impacted by the August 2016 flood as other parts of Baton Rouge. So I decided to dig a little deeper and share with you what’s going on in my neighborhood.

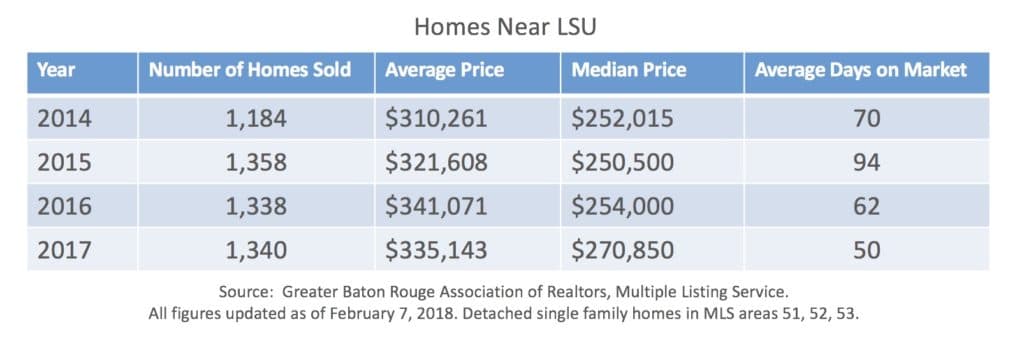

Here’s our chart from last year updated with this years’ numbers. After a significant rise in 2016, average home prices are holding steady. In light of the market upheaval we experienced after the flood, I’d say that’s pretty good news.

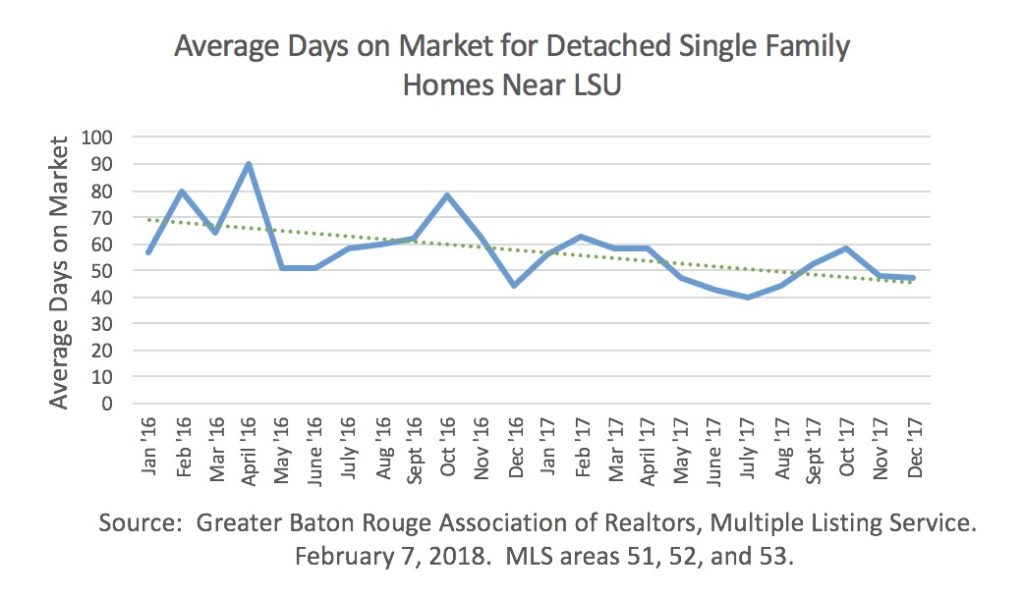

What I think is important to keep an eye on this year is “supply” and “days on market.” As of this morning there are 366 detached single family homes available in the areas between LSU and Country Club of Louisiana. Last year 1,340 homes were sold in this area. So, that means that there is currently a 3.3 month supply of homes available. For home sellers this is very good news. And take a look at what’s happened to days on market.

Predicting what’s going to happen to home values is a pretty risky business, especially in this part of Baton Rouge where you have a lot of variety in the types of homes available, their age, and condition. But when you have an asset that’s in short supply in an economy that’s strong, I think it’s reasonable to believe that home values should rise.

Real estate is local. Your agent should be, too. If you’re thinking about buying or selling a home in areas near LSU give me a call. The number is (225) 772-8709 or email me at [email protected].

Published: October 5, 2017

Filed Under: Market Trends, New Construction

Those of us who live in Baton Rouge may not be aware of all that’s happening in our neighboring parishes. You’ve likely heard about the schools in Ascension Parish and maybe some friends or acquaintances have moved there over the years. Here’s some data from the Greater Baton Rouge Association of Realtors to help put it in perspective.

Talk about growth … the residential areas near Prairieville are rockin’ it! It’s about the schools, the cost of homes, the availability of new construction, financing options for homes in rural areas, and that little bit of “country” that makes Louisiana like no place else.

This month I’ve expanded HeleneKurtz.com to include Homes Near Prairieville. You can search by price, by subdivision, look for homes that were just listed, and also search for new construction. And, there’s a lot of it. With the exception of the Nicholson/Burbank corridors there aren’t too many options for new construction near LSU and Towne Center. We just don’t have much land and the lots that are available are often very expensive. You can see why so many find what’s happening in Prairieville so attractive. If you’d like to go take a look at homes in Prairieville, give me a call at (225) 772-8709 and check out the homes on HeleneKurtz.com/Homes Near Prairieville.

Published: February 17, 2017

Filed Under: Market Trends

Looking for a home in the LSU area this Spring? You’re gonna need some help.

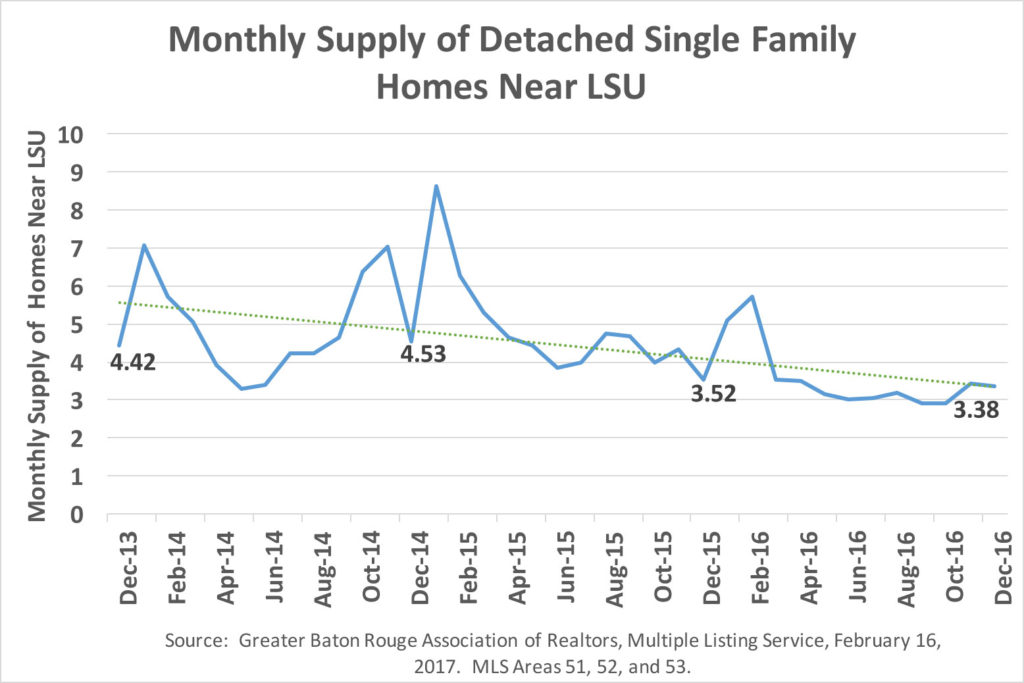

Over the past couple of years the monthly supply of homes, a key indicator of the balance between supply and demand, has gradually gone down in the areas surrounding LSU. Since the August 2016 flood that trend has continued. Those of us who live here know that since August the traffic on Perkins, Highland, Acadian, Essen, and Bluebonnet has increased dramatically as our neighbors from other parts of the Parish have moved here. We’re all having to give ourselves more time to get to wherever we need to go. So it’s not surprising that in December there was just a 3.38 month supply of detached single family homes near LSU. That’s a classic indicator of a seller’s market and it’s made finding a home near LSU a real challenge.

Is it temporary or permanent and what impact has all of this had on home sales and values? It looks like at least some of the people in those long lines of traffic have decided to stay in the area. Low inventories mean that nice homes are not going to stay on the market very long if they’re priced right and in good condition.

Not surprisingly, we’re also seeing an increase in home values. Since 2014, the average price of a detached single family home in the areas near LSU have increased from $310,261 to $341,217 … a 10.0% increase. It’s hard to say what affect the flood has had on value but my daily experience helping clients buy and sell homes suggests that we’re looking at a sustained upward shift in the price of homes. It’s just my opinion, but I don’t think it’s like Katrina when folks who moved here went back to New Orleans. I think that flood victims who have decided to buy homes in area 5 … homes near LSU … are likely to stay.

So, what do you do if you’re in the market for a home near LSU? Work with a responsive and experienced agent who can:

1) Send you listings, directly from the MLS, as soon as they are entered into our systems,

2) Help you negotiate the deal. You don’t want to be in a multiple offer situation without a pro by your side,

3) Help you identify the resources you need to successfully move the purchase through the contract to close process, e.g., lenders, home inspectors, contractors, title companies, insurance agents.

And don’t forget …

4) Get yourself pre-qualified for a loan! Know how much you can afford and be prepared to act quickly. Most sellers will not consider an offer without a pre qualification letter or proof of funds for an all cash transaction.

If you’re thinking about buying a home this Spring call me at (225) 772-8709, email me at [email protected] and visit my website, http://www.HeleneKurtz.com.

Published: January 12, 2014

Filed Under: Market Trends

Baton Rouge used to be New Orleans’ second cousin, but not so much anymore. Just take a look at what’s happening all around us, and you can’t help but be positive about Baton Rouge. The leaders of our business community have declared 2013 a game changing year and here’s why.

In March we learned that IBM had reached an agreement with area leaders to open a business services center in a new riverfront complex downtown. This announcement was followed in December with news of a downtown 28-acre Water Campus dedicated to ground breaking research in the areas of coastal erosion and the environment. We also learned we were getting a branch of the LSU Medical School right here in Baton Rouge.

In 2013 there were some other major annoucements and developments as well. Construction of new Acadian Village Shopping Center was completed and Trader Joe’s joined the area’s mix of upscale grocers. Costco announced it was coming to Baton Rouge. Construction also began on the Super Walmart at Bluebonnet and Burbank. And, Matherne’s announced it will open a much needed new super market in downtown Baton Rouge.

When CB&I purchased The Shaw Group some were concerned about the impact on Baton Rouge, but it’s turned out well. CB&I has increased their local presence and Jim Bernhard, Shaw’s CEO and Founder, has opened new venture capital offices downtown. Even our local newspaper changed ownership. In May, John Georges, a successful New Orleans businessman and entrepreneur, purchased The Advocate from the Manship family. The blending of news and reporting from New Orleans, Lafayette, and Baton Rouge has engaged readers and is creating an awareness of Baton Rouge’s regional importance and impact.

So, when people ask me “How’s the real estate market?” I have to put it in the context of the overall growth in the Baton Rouge community. While there is some concern about rising interest rates an increase into the 5% range is still low compared to high interest rate environments in the past. We have a strong employment base. We have major investments taking place in our community, and I am very positive about the future. That optimism is reflected in last year’s area home sales and also all the new home construction currently underway. Here’s to 2014!

| 2012 | 2013 | % Change | ||||

| Detached Single Family Homes | # Homes Sold | Average Price | # Homes Sold | Average Price | # Homes Sold | Average Price |

| Near LSU | 971 | $283,900 | 1,147 | $301,208 | 18.1% | 6.1% |

| Near Towne Center | 444 | $303,396 | 450 | $291,438 | 1.4% | -3.9% |

| Near Shenandoah | 724 | $209,421 | 815 | $223,888 | 12.6% | 6.9% |

| Zachary | 298 | $220,207 | 377 | $213,598 | 26.5% | -3.0% |

| Central | 62 | $214,754 | 101 | $232,181 | 62.9% | 8.1% |

| All East Baton Rouge Parish | 3,680 | $209,381 | 4,174 | $218,615 | 13.4% | 4.4% |

Source: Greater Baton Rouge Association of Realtors, Multiple Listing Service, January 12, 2014

Published: November 7, 2013

Filed Under: Market Trends, Videos

You’ve likely seen a lot of information in the news about increases to flood insurance premiums. Homeowners are reasonably concerned about the impact these changes will have on the cost of coverage and the value of their homes. I’ve also seen and heard a lot of misinformation. The information in this post is from FEMA. Their website is excellent and while their videos are not the most entertaining, they are informative.

Here are some things you should know as well as key provisions of the plan.

Changes to the National Flood Insurance Program (NFIP) came about through legislation called the Biggert-Waters Flood Insurance Reform Act of 2012.

The law requires changes to all major components of the program, not just flood insurance premiums. Additionally included is flood hazard mapping, grants, and the management of floodplains. Primary and secondary residences are affected as well as businesses.

The reason for the change was that the premium structure didn’t reflect the true risks and costs of flooding. Some homeowners and businesses were receiving insurance at “subsidized” rates.

In Louisiana 83% of NFIP policy holders have policies that are already “acturarially rated” meaning that the premiums on these policies reflect current risk.

10% of all Louisiana NFIP policies cover subsidized primary residences, which will remain subsidized unless or until the property is sold (new rates will be charged to the next owner) or the policy lapses.

4% of Louisiana’s NFIP policies will see increases up to 25% each year until premiums reflect full risk rates. These include non-primary residences, businesses, and severe repetitive loss properties.

Currently House and Senate leaders are involved in bi-partisan discussions and have proposed delays to increases in premiums for primary, non-repetitive loss residences that are currently grandfathered, all properties sold after July 6, 2012, and all properties that purchase a new policy after July 6, 2012. These suggested revisions are in the proposal stage. A vote has not been taken.

The best source of information on flood insurance premiums is your insurance agent. Carter Fourrier, with the Fourrier Agency, was recently at our office to explain the law and it’s provisions. You might want to give them a call as we all found the discussion very help and Carter and his team are highly knowledgeable. Go to: www.fourrieragency.com or call Carter at (225) 383-0682.

The FEMA website has lots of information and videos. I will post the ones I find most interesting. You should also visit the FEMA site, www.FEMA.gov.

LSU has a handy website that can show you were you home is located. Go to: maps.LSUAgCenter.com. Please note, however, that these floodmaps may not be 100% accurate. You may need to get a flood elevation certificate or there may be map adjustments that are not currentlly reflected by the mapping tools.

Published: September 16, 2013

Filed Under: Market Trends, Real Estate Investing

When you list your home for sale, hire an agent who out performs the market. How did I do that? Give me a call at (225) 772-8709.

| September 2012 – September 2013 | Average Days on Market | Average Continuous Days on Market | % Sold/List Price |

| Helene Kurtz | 45 | 56 | 97.9% |

| All Baton Rouge Agents | 91 | 114 | 97.0% |

Source: Greater Baton Rouge Association of Realtors Multiple Listing Service, Sales and Inventory Report. September 16, 2013.

Published: August 14, 2013

Filed Under: Market Trends, Videos

Here’s the latest from the Greater Baton Rouge Association of Realtors. Home prices are returning to pre-recession levels and inventory is at a 5 year low.

Published: January 3, 2013

Filed Under: Market Trends, Real Estate Investing

Wondering how the new legislation passed to avoid the “fiscal cliff” might affect your real estate investments? This information was posted on the realtor.org website this morning.

Real Estate Extenders

Permanent Repeal of Pease Limitations for 99% of Taxpayers

Under the agreement so called “Pease Limitations” that reduce the value of itemized deductions are permanently repealed for most taxpayers but will be reinstituted for high income filers. These limitations will only apply to individuals earning more than $250,000 and joint filers earning above $300,000. These thresholds have been increased and are indexed for inflation and will rise over time. Under the formula, the amount of adjusted gross income above the threshold is multiplied by three percent. That amount is then used to reduce the total value of the filer’s itemized deductions. The total amount of reduction cannot exceed 80 percent of the filer’s itemized deductions.

These limits were first enacted in 1990 (named for the Ohio Congressman Don Pease who came up with the idea) and continued throughout the Clinton years. They were gradually phased out as a result of the 2001 tax cuts and were completely eliminated in 2010-2012. Had we gone over the fiscal cliff, Pease limitations would have been reinstituted on all filers starting at $174,450 of adjusted gross income.

Capital Gains

Capital Gains rate stays at 15 percent for those in the top rate of $400,000 (individual) and $450,000 (joint) return. After that, any gains above those amounts will be taxed at 20 percent. The $250,000/$500,000 exclusion for sale of principle residence remains in place.

Estate Tax

The first $5 million dollars in individual estates and $10 million for family estates are now exempted from the estate tax. After that the rate will be 40 percent, up from 35 percent. The exemption amounts are indexed for inflation.