Published: February 27, 2018

Filed Under: Market Trends, Real Estate Investing

Have you seen all the new construction just a little bit north of the LSU campus?

Yes, I said north … not south. If you drive up there you will see new building after new building being built. My husband came home the other day and said, “What is that?”

Well, it’s LSU’s Nicholson Gateway Development. It’s 28 acres that will include apartment homes for upperclass men and women as well as graduate students. It also includes rec space, retail space, parking, and the LSU Foundation offices. The project is funded jointly by the LSU Property Foundation and private developers.

You’d think with all the new rental construction going on south of the LSU campus that we wouldn’t need anymore student housing. And, if you own a townhome or a condo nearby that your children live in while attending LSU you’ve got to be wondering what impact all this will have on your property values.

During the past few years we’ve seen new construction at The Cottages (now The Lodges at 777), The Exchange, Arlington Cottages and Townhomes, Wildwood, The Woodlands, Sterling Burbank and I’m sure I’ve left out a few. Not surprisingly, it’s about the money and what it costs to send your child to LSU.

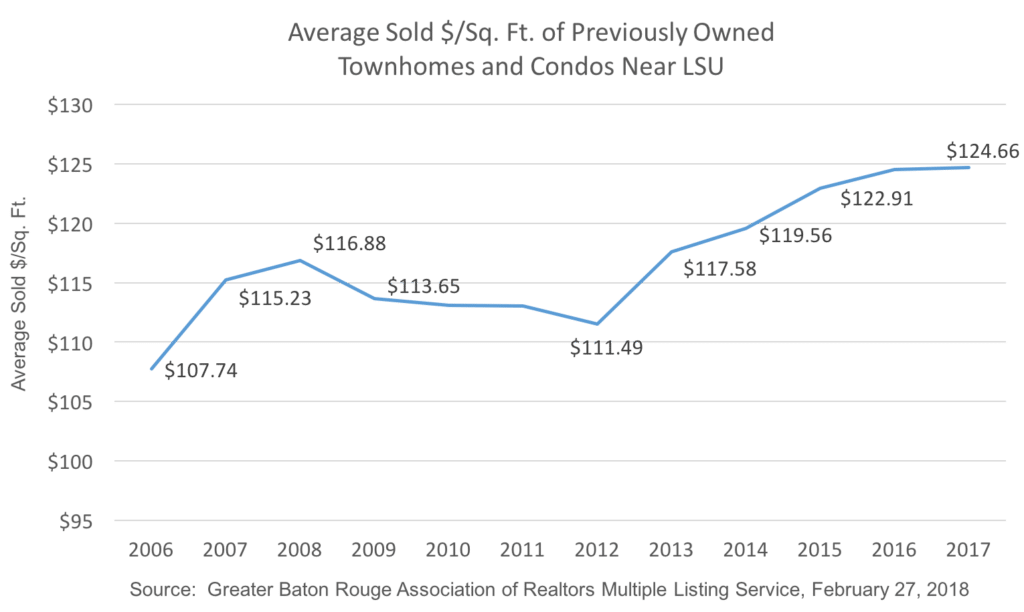

The graph above includes all attached home sales (condos, townhomes, and duplexes) in MLS area 52 that were previously owned, i.e., not new construction. I decided to eliminate new construction from this analysis because it really is very different from the inventory of existing homes. Including those homes in the year they were introduced really screws these numbers.

What you see is that after Katrina we had a run up in the cost of condos, townhomes, and duplexes in the area. Some of that was speculative, and some was just a concern about having a place to go if you lived in New Orleans and a major hurricane was on it’s way. But around 2008 our market started to shift. There are a number of factors that contributed to this, and honestly, these averages smooth the losses in value in some student-centric neighborhoods near LSU.

When you combine the post-post Katrina effect of New Orleans residents returning home, with the problems the US economy was experiencing in 2008 – 2011, it’s not surprising that parents were not too keen on buying property for their children. Having worked with many parents during those years what I heard was,

“When the stock market looses that much value, you just don’t feel as comfortable buying a second home for your kids.”

What changed?

In 2011 The Cottages of Baton Rouge opened. They were nice. They were new. And they were expensive. As more and more new apartments were built, with rents around $700- $800/month per student for a 2 bedroom apartment and $600 – $700/month per student for a 3 bedroom apartment, the surrounding existing inventory started to once again become attractive.

A 2 bedroom/2 bath apartment at LSU’s new Nicholson Gateway Apartments will cost you $4,940/semester per student. That’s $9,960 for two semesters, and if you stay for the summer months it’s an additional $2,470. So that’s a little more than $1,000/month!

Click here for a link to the fee schedule. That’s pretty swank for a college kid. I have no doubt they will be very nice and a needed and welcome addition to the north side of the campus. For most of the parents I work with, however, they’re still going to be interested in some lower cost alternatives on the south side of the campus.

Published: September 16, 2013

Filed Under: Market Trends, Real Estate Investing

When you list your home for sale, hire an agent who out performs the market. How did I do that? Give me a call at (225) 772-8709.

| September 2012 – September 2013 | Average Days on Market | Average Continuous Days on Market | % Sold/List Price |

| Helene Kurtz | 45 | 56 | 97.9% |

| All Baton Rouge Agents | 91 | 114 | 97.0% |

Source: Greater Baton Rouge Association of Realtors Multiple Listing Service, Sales and Inventory Report. September 16, 2013.

Published: January 3, 2013

Filed Under: Market Trends, Real Estate Investing

Wondering how the new legislation passed to avoid the “fiscal cliff” might affect your real estate investments? This information was posted on the realtor.org website this morning.

Real Estate Extenders

Permanent Repeal of Pease Limitations for 99% of Taxpayers

Under the agreement so called “Pease Limitations” that reduce the value of itemized deductions are permanently repealed for most taxpayers but will be reinstituted for high income filers. These limitations will only apply to individuals earning more than $250,000 and joint filers earning above $300,000. These thresholds have been increased and are indexed for inflation and will rise over time. Under the formula, the amount of adjusted gross income above the threshold is multiplied by three percent. That amount is then used to reduce the total value of the filer’s itemized deductions. The total amount of reduction cannot exceed 80 percent of the filer’s itemized deductions.

These limits were first enacted in 1990 (named for the Ohio Congressman Don Pease who came up with the idea) and continued throughout the Clinton years. They were gradually phased out as a result of the 2001 tax cuts and were completely eliminated in 2010-2012. Had we gone over the fiscal cliff, Pease limitations would have been reinstituted on all filers starting at $174,450 of adjusted gross income.

Capital Gains

Capital Gains rate stays at 15 percent for those in the top rate of $400,000 (individual) and $450,000 (joint) return. After that, any gains above those amounts will be taxed at 20 percent. The $250,000/$500,000 exclusion for sale of principle residence remains in place.

Estate Tax

The first $5 million dollars in individual estates and $10 million for family estates are now exempted from the estate tax. After that the rate will be 40 percent, up from 35 percent. The exemption amounts are indexed for inflation.