Published: February 27, 2018

Filed Under: Market Trends, Real Estate Investing

Have you seen all the new construction just a little bit north of the LSU campus?

Yes, I said north … not south. If you drive up there you will see new building after new building being built. My husband came home the other day and said, “What is that?”

Well, it’s LSU’s Nicholson Gateway Development. It’s 28 acres that will include apartment homes for upperclass men and women as well as graduate students. It also includes rec space, retail space, parking, and the LSU Foundation offices. The project is funded jointly by the LSU Property Foundation and private developers.

You’d think with all the new rental construction going on south of the LSU campus that we wouldn’t need anymore student housing. And, if you own a townhome or a condo nearby that your children live in while attending LSU you’ve got to be wondering what impact all this will have on your property values.

During the past few years we’ve seen new construction at The Cottages (now The Lodges at 777), The Exchange, Arlington Cottages and Townhomes, Wildwood, The Woodlands, Sterling Burbank and I’m sure I’ve left out a few. Not surprisingly, it’s about the money and what it costs to send your child to LSU.

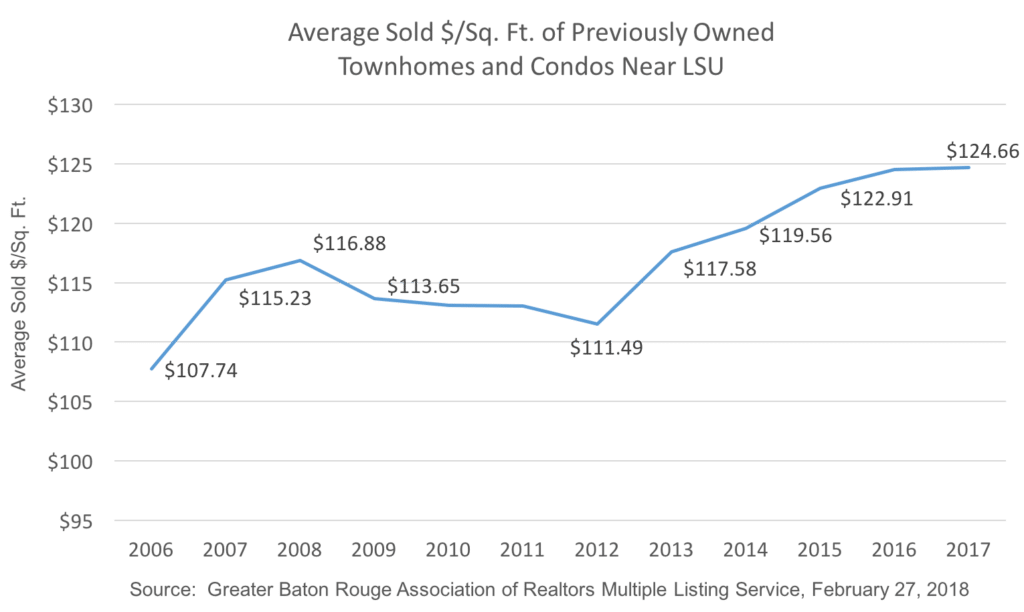

The graph above includes all attached home sales (condos, townhomes, and duplexes) in MLS area 52 that were previously owned, i.e., not new construction. I decided to eliminate new construction from this analysis because it really is very different from the inventory of existing homes. Including those homes in the year they were introduced really screws these numbers.

What you see is that after Katrina we had a run up in the cost of condos, townhomes, and duplexes in the area. Some of that was speculative, and some was just a concern about having a place to go if you lived in New Orleans and a major hurricane was on it’s way. But around 2008 our market started to shift. There are a number of factors that contributed to this, and honestly, these averages smooth the losses in value in some student-centric neighborhoods near LSU.

When you combine the post-post Katrina effect of New Orleans residents returning home, with the problems the US economy was experiencing in 2008 – 2011, it’s not surprising that parents were not too keen on buying property for their children. Having worked with many parents during those years what I heard was,

“When the stock market looses that much value, you just don’t feel as comfortable buying a second home for your kids.”

What changed?

In 2011 The Cottages of Baton Rouge opened. They were nice. They were new. And they were expensive. As more and more new apartments were built, with rents around $700- $800/month per student for a 2 bedroom apartment and $600 – $700/month per student for a 3 bedroom apartment, the surrounding existing inventory started to once again become attractive.

A 2 bedroom/2 bath apartment at LSU’s new Nicholson Gateway Apartments will cost you $4,940/semester per student. That’s $9,960 for two semesters, and if you stay for the summer months it’s an additional $2,470. So that’s a little more than $1,000/month!

Click here for a link to the fee schedule. That’s pretty swank for a college kid. I have no doubt they will be very nice and a needed and welcome addition to the north side of the campus. For most of the parents I work with, however, they’re still going to be interested in some lower cost alternatives on the south side of the campus.

Published: October 5, 2017

Filed Under: Market Trends, New Construction

Those of us who live in Baton Rouge may not be aware of all that’s happening in our neighboring parishes. You’ve likely heard about the schools in Ascension Parish and maybe some friends or acquaintances have moved there over the years. Here’s some data from the Greater Baton Rouge Association of Realtors to help put it in perspective.

Talk about growth … the residential areas near Prairieville are rockin’ it! It’s about the schools, the cost of homes, the availability of new construction, financing options for homes in rural areas, and that little bit of “country” that makes Louisiana like no place else.

This month I’ve expanded HeleneKurtz.com to include Homes Near Prairieville. You can search by price, by subdivision, look for homes that were just listed, and also search for new construction. And, there’s a lot of it. With the exception of the Nicholson/Burbank corridors there aren’t too many options for new construction near LSU and Towne Center. We just don’t have much land and the lots that are available are often very expensive. You can see why so many find what’s happening in Prairieville so attractive. If you’d like to go take a look at homes in Prairieville, give me a call at (225) 772-8709 and check out the homes on HeleneKurtz.com/Homes Near Prairieville.

Published: February 17, 2017

Filed Under: Market Trends

Looking for a home in the LSU area this Spring? You’re gonna need some help.

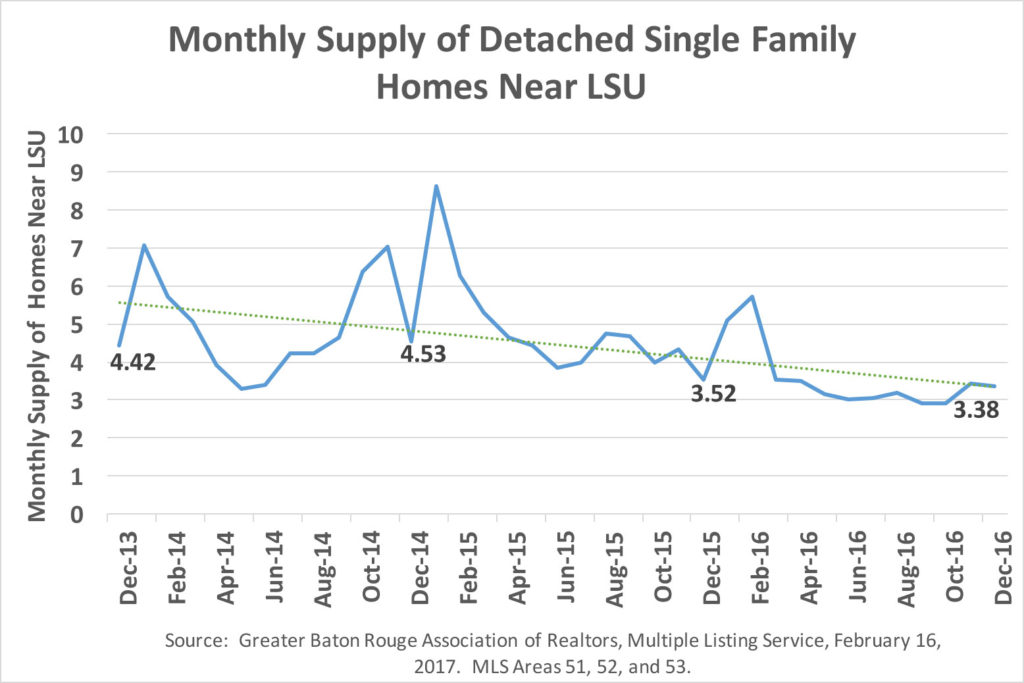

Over the past couple of years the monthly supply of homes, a key indicator of the balance between supply and demand, has gradually gone down in the areas surrounding LSU. Since the August 2016 flood that trend has continued. Those of us who live here know that since August the traffic on Perkins, Highland, Acadian, Essen, and Bluebonnet has increased dramatically as our neighbors from other parts of the Parish have moved here. We’re all having to give ourselves more time to get to wherever we need to go. So it’s not surprising that in December there was just a 3.38 month supply of detached single family homes near LSU. That’s a classic indicator of a seller’s market and it’s made finding a home near LSU a real challenge.

Is it temporary or permanent and what impact has all of this had on home sales and values? It looks like at least some of the people in those long lines of traffic have decided to stay in the area. Low inventories mean that nice homes are not going to stay on the market very long if they’re priced right and in good condition.

Not surprisingly, we’re also seeing an increase in home values. Since 2014, the average price of a detached single family home in the areas near LSU have increased from $310,261 to $341,217 … a 10.0% increase. It’s hard to say what affect the flood has had on value but my daily experience helping clients buy and sell homes suggests that we’re looking at a sustained upward shift in the price of homes. It’s just my opinion, but I don’t think it’s like Katrina when folks who moved here went back to New Orleans. I think that flood victims who have decided to buy homes in area 5 … homes near LSU … are likely to stay.

So, what do you do if you’re in the market for a home near LSU? Work with a responsive and experienced agent who can:

1) Send you listings, directly from the MLS, as soon as they are entered into our systems,

2) Help you negotiate the deal. You don’t want to be in a multiple offer situation without a pro by your side,

3) Help you identify the resources you need to successfully move the purchase through the contract to close process, e.g., lenders, home inspectors, contractors, title companies, insurance agents.

And don’t forget …

4) Get yourself pre-qualified for a loan! Know how much you can afford and be prepared to act quickly. Most sellers will not consider an offer without a pre qualification letter or proof of funds for an all cash transaction.

If you’re thinking about buying a home this Spring call me at (225) 772-8709, email me at [email protected] and visit my website, http://www.HeleneKurtz.com.

Published: January 12, 2014

Filed Under: Market Trends

Baton Rouge used to be New Orleans’ second cousin, but not so much anymore. Just take a look at what’s happening all around us, and you can’t help but be positive about Baton Rouge. The leaders of our business community have declared 2013 a game changing year and here’s why.

In March we learned that IBM had reached an agreement with area leaders to open a business services center in a new riverfront complex downtown. This announcement was followed in December with news of a downtown 28-acre Water Campus dedicated to ground breaking research in the areas of coastal erosion and the environment. We also learned we were getting a branch of the LSU Medical School right here in Baton Rouge.

In 2013 there were some other major annoucements and developments as well. Construction of new Acadian Village Shopping Center was completed and Trader Joe’s joined the area’s mix of upscale grocers. Costco announced it was coming to Baton Rouge. Construction also began on the Super Walmart at Bluebonnet and Burbank. And, Matherne’s announced it will open a much needed new super market in downtown Baton Rouge.

When CB&I purchased The Shaw Group some were concerned about the impact on Baton Rouge, but it’s turned out well. CB&I has increased their local presence and Jim Bernhard, Shaw’s CEO and Founder, has opened new venture capital offices downtown. Even our local newspaper changed ownership. In May, John Georges, a successful New Orleans businessman and entrepreneur, purchased The Advocate from the Manship family. The blending of news and reporting from New Orleans, Lafayette, and Baton Rouge has engaged readers and is creating an awareness of Baton Rouge’s regional importance and impact.

So, when people ask me “How’s the real estate market?” I have to put it in the context of the overall growth in the Baton Rouge community. While there is some concern about rising interest rates an increase into the 5% range is still low compared to high interest rate environments in the past. We have a strong employment base. We have major investments taking place in our community, and I am very positive about the future. That optimism is reflected in last year’s area home sales and also all the new home construction currently underway. Here’s to 2014!

| 2012 | 2013 | % Change | ||||

| Detached Single Family Homes | # Homes Sold | Average Price | # Homes Sold | Average Price | # Homes Sold | Average Price |

| Near LSU | 971 | $283,900 | 1,147 | $301,208 | 18.1% | 6.1% |

| Near Towne Center | 444 | $303,396 | 450 | $291,438 | 1.4% | -3.9% |

| Near Shenandoah | 724 | $209,421 | 815 | $223,888 | 12.6% | 6.9% |

| Zachary | 298 | $220,207 | 377 | $213,598 | 26.5% | -3.0% |

| Central | 62 | $214,754 | 101 | $232,181 | 62.9% | 8.1% |

| All East Baton Rouge Parish | 3,680 | $209,381 | 4,174 | $218,615 | 13.4% | 4.4% |

Source: Greater Baton Rouge Association of Realtors, Multiple Listing Service, January 12, 2014

Published: August 14, 2013

Filed Under: Market Trends, Videos

Here’s the latest from the Greater Baton Rouge Association of Realtors. Home prices are returning to pre-recession levels and inventory is at a 5 year low.

Published: January 18, 2012

Filed Under: Market Trends

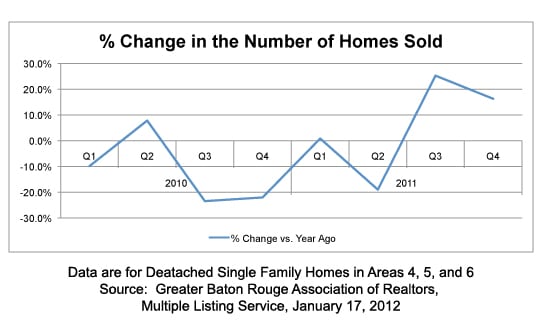

I was glad to see the front page of The Advocate this morning: BR-area home sales up 3% in 2011. All of us in the real estate business and those of you thinking about selling your home in 2012 should feel good about that. But as Paul Harvey, a great old-time radio broadcaster, used to say, here’s “the rest of the story.” The gains were made in the second half of the year and correspond with a decrease in the average price of sold homes.

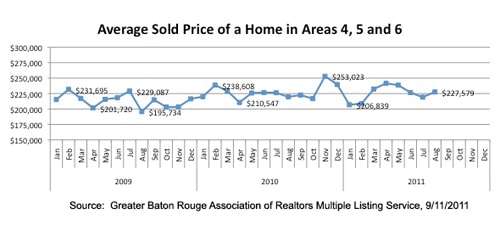

Here’s the data for areas 4, 5, and 6 – LSU and south to Shenandoah and east. With the exception of the 2nd quarter of 2010, which marked the end of the housing stimulus programs, we've seen a consistent decline in the number of homes sold vs. year ago until the 3rd quarter of this year.

Those of us who live real estate all day every day know that something happened in the 3rd quarter. This market started to turn around and homes started moving again.

I think there were two major factors that have contributed to the turn around: 1) buyers and sellers realized that there weren’t going to be any more stimulus programs. The national economy just wasn’t going to support more government spending at that level. 2) Interest rates have been at phenomenally low levels. Those low rates have a tremendous impact on affordability and drove buyers who were on the fence into the market.

Digging a little deeper into the data you can also see that there was a corresponding shift in the average price of sold homes.

There are lots of possible reasons for this. It could be that there were more sales in the lower price ranges. It could be that we had fewer high-end sales. It could be that we had more foreclosures. But the most logical reason for this is that home prices have genuinely come down. And, in fact, if you go through the data neighborhood by neighborhood, you will see that more often than not, that is the case.

How much have home prices come down? That depends on the house, it’s condition, and the neighborhood. There are areas in Baton Rouge where home values really haven’t been affected. And, there are others where there have been significant declines in the average sales price per square foot. One thing I feel really comfortable saying is that a home in a good location, in good condition, priced right, and professionally marketed is going to sell. And, if you are a buyer, it’s time to make your move! The market has shifted, the rates are low, and the local economy is in reasonably good shape.

If a move is in your future, please give me a call. Till next time.

Published: September 13, 2011

Filed Under: Market Trends

It seems that every day we get bombarded with negative news. OK – things have not been great, but the sky is not falling and it looks like low interest rates are at long last helping our real estate market. For those of you who know me from my “pre real estate life” you know I’m one good market analyst. NOW would be a really good time to list your home. Take a look at the stats below.

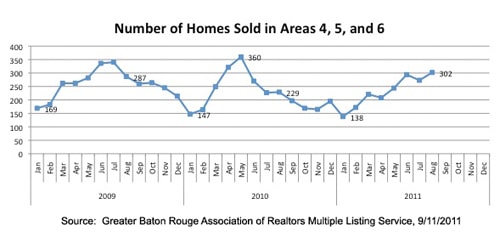

Home Sales are Picking Up

Home sales are seasonal. The number of homes sold tend to bottom out in January and peak in June and July as families complete their moves before the school year begins. And, while we were off to a slow start this year, the past few months have been good. In fact, August sales in areas 4, 5, and 6 put in their strongest showing in 3 years. (August 2009 – 287 homes sold, August 2010 – 229 homes sold, August 2011 – 302 homes sold).

What I think is really important about this is that the improvement in home sales has been accomplished without additional tax credits. Yes, they were great and they helped us sell homes in the Spring of 2010. But, they didn’t help long term. They just shifted demand. What we are seeing now is different. I think it’s the low interest rates. I just can’t imagine it getting any better than this for a home buyer.

Home Prices Are Holding Steady

From month to month, the average price of a sold home in the area is going to fluctuate. What’s noteworthy about home values in areas 4, 5, and 6 is that despite some bumpy economic times, our home values have remained relatively steady. Compare Baton Rouge to what’s happened in cities in California and Florida. We have so much to be thankful for here. And, I think about that every day.

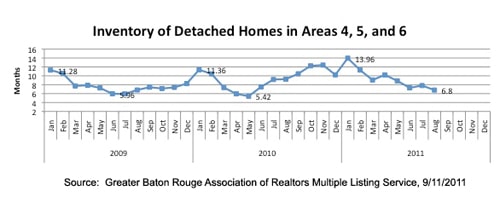

Inventory Levels are Dropping

While the number of homes sold and the average price is nice to know, what matters most when you list your home for sale is the competition: How many homes are available that are similar to yours? We tend to look at historical data because that’s what appraisers must use in determining home values. But, the buyer for your home can’t buy a home that is already sold. They choose from the existing inventory.

If you’re thinking about selling your home, let’s talk about what happening in your neighborhood.